Canada’s Ventures to Value Chains: Agri-Food is part of a Foresight initiative leveraging data from technology companies and other key stakeholders to map, categorize, and analyze strategically important industry value chains for Canada in the clean economy.

Building a Resilient Agri-Food Sector Through Innovation

Canada’s Prairie region spans three provinces, covers a total area of 465,094 km2, and provides some of the best farmland in the world. Farmland covers roughly 94 per cent of the Prairie ecozone, so it’s no surprise that Canada’s ag-sector is a major driver of economic activity.

In 2022, the sector employed one of every nine Canadians and was responsible for seven per cent of GDP. In order to secure long-term prosperity for the sector, the increased focus by Canadian companies on research, development, and commercialization of agri-tech is essential.

Foresight’s work to map agri-food technology innovators attempts to illuminate where Canadian companies are already using innovations such as controlled environment agriculture (CEA) or precision agriculture technologies to respond to rapidly changing agricultural needs.

Agri-tech offers the potential to boost productivity while building resiliency, transparency, and security throughout Canada’s food supply chain.

These insights will support our understanding of the landscape of technology innovation in Canada’s agri-food sector while outlining strengths and opportunities to grow its market share and environmental impact.

This report is available for download. Submit this form for access.

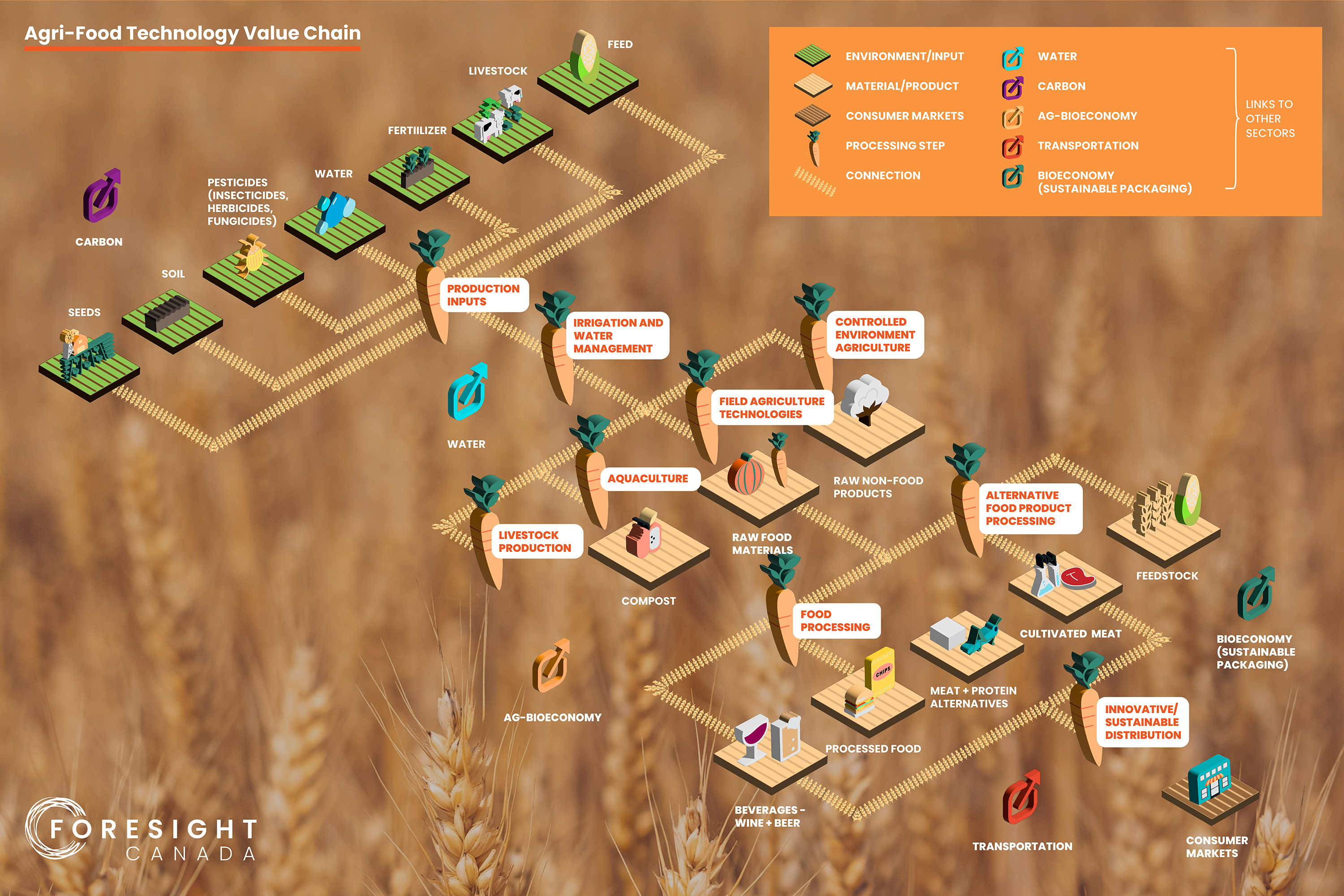

Agri-Food Technology: The Value Chain

The agri-food technology value chain describes the connection between livestock, biomass and other agricultural inputs to various processing steps and the links to endpoints such as users, markets, or the environment.

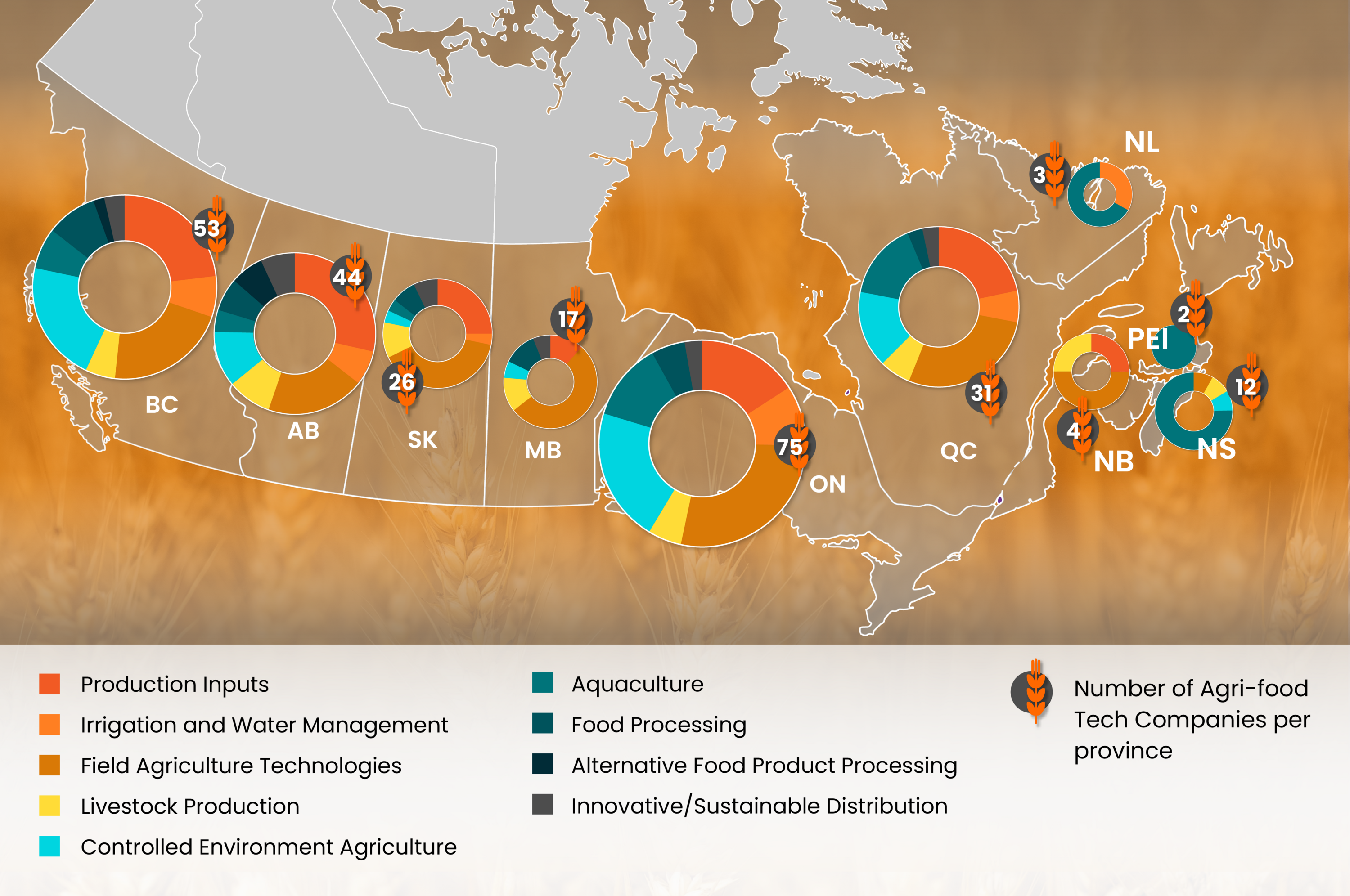

Canada’s Agri-Food Technology Companies

267 companies were assigned to Canada’s agri-food tech value chain. Companies were found to be highly concentrated in Canada’s four largest provinces: Ontario, BC, Alberta and Québec; and in four key value chain steps, including field agriculture technology and controlled environment agriculture.

Our data and analysis indicate and discuss trends and clustering, areas of competitive strength, and potential opportunities for growth. Some of the key takeaways include:

- Ontario is the provincial leader in agri-tech, with diverse companies across the value chain

- The majority of aquaculture technology companies reside in Atlantic Canada

- Controlled Environment Agriculture and precision agriculture technologies are areas of national opportunity that offer benefits and potential to reduce GHGs, reduce strain on our natural resources, and improve the sector’s resiliency

+MORE

Why is this important?

Foresight’s venture acceleration programming emphasizes the importance of understanding your value chain.

Knowing where a company fits along the value chain, which companies or technologies come before or after, who the competitors are, and where trends are happening geographically is critical information for ventures, industry, and investors to understand.

This information is also highly important for governments to identify areas of strength, gaps, and opportunities in the innovation landscape, pinpoint areas for targeted support and where targeted R&D and project funding will deliver the greatest return on investment for Canada’s communities and environment.

The Canada’s Ventures to Value Chains: Agri-Food database and analysis report are invaluable tools intended to provide the Helix-5™ ecosystem unique insights into the landscape of Canadian Agri-Tech.

Interested in learning more about Canada’s agri-food technology value chain? Download the full report below.